when to submit borang e 2019

Failure to submit the Form E on or before 31 March 2020 is a criminal offense and can be prosecuted in court. Complete Edit or Print Tax Forms Instantly.

Borang E Archives Tax Updates Budget Business News

- Penalty under subsection 1123 of the Income Tax Act 1967 ITA 1967.

. Do Your 2021 2020 any past year return online Past Tax Free to Try. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Borang e 2019 due date Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 16 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2022 dan.

Posted in borang b. 1 2019 CP8 - Pin. Borang b 2019 due date.

Borang E for e-filing submission. Employers who have e-Data Praisi need not complete and furnish CP8D. Failure to submit the Form E on or before 31 March 2020 is a criminal offense and can be prosecuted in court.

B Failure to furnish Form E on or before 31 March 2020 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967. B Failure to furnish Form E on or before 31 March 2020 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967. Sign screen will be displayed as below.

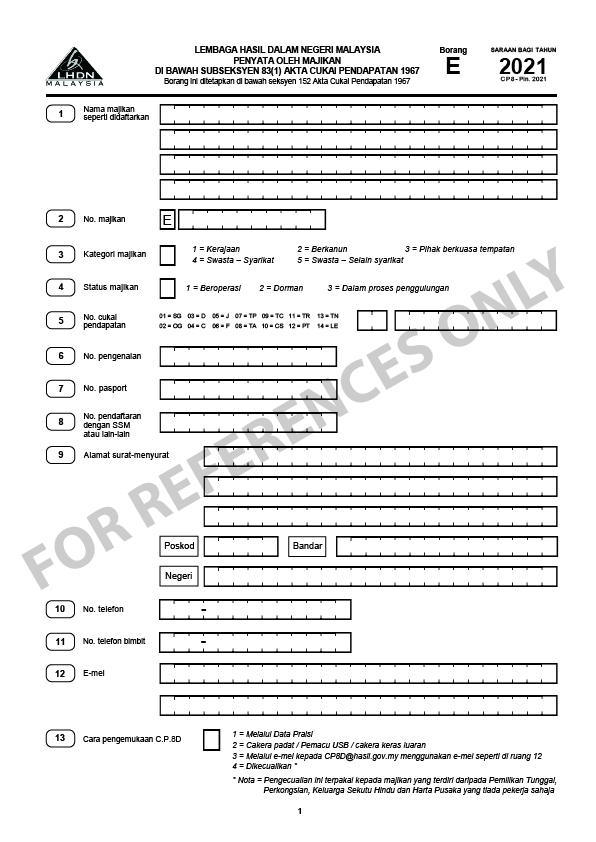

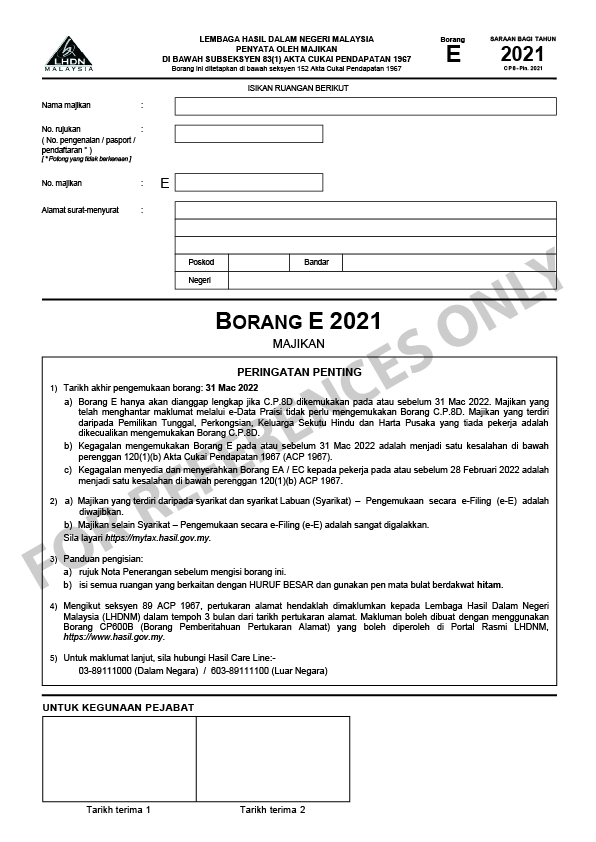

2019 Borang SARAAN BAG I TAHUN E LEMBAGA HASIL DALAM NEGERI MALAYSIA PENYATA OLEH MAJIKAN CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 Tarikh terima 1 Tarikh terima 2 UNTUK KEGUNAAN PEJABAT E. BORANG E 2019 Nama majikan. Failure to submit the Form E.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. Easy Fast Secure.

A Form E will only be considered complete if CP8D is submitted on or before 31 March 2020. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2019 adalah menjadi satu kesalahan di bawah. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

31 Mac 2020 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020. Continue button to submit your e-Form. Borang E 2021 PDF Reference Only.

At Declaration screen you are able to. Easy Fast Secure. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees.

BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. Click on Sign and Submit button to submit your e-Form. Refund will be notified by e-mail.

Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. Basically it is a tax return form informing the irb lhdn of the list of employee income information and number of employees it must be. Failure in submitting Borang E will result in the IRB taking legal action against the companys directors.

31 Mac 2020 a Borang E hanya akan dianggap. Sign and Submit button To submit form. On and before 3042022.

Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. A TAC which is needed to sign and submit your e-form will be sent to your handphone number registered to LHDN so ensure it is correct. Back button To return to previous screen.

How to use LHDN E-filing platform to file E form Borang E to LHDN ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2021 in accordance with subsection 83 1B of the Income Tax Act ITA 1967. Print Form Draft button Print form in PDF format. Nama 5 7 Negeri-No.

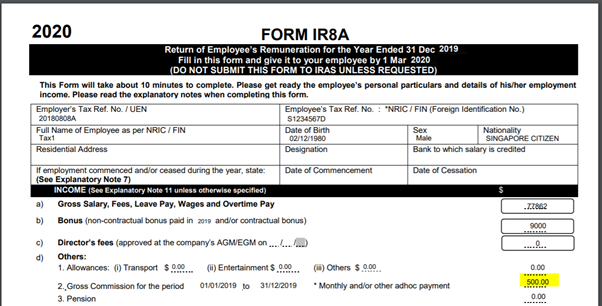

A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees. EA CP8C must be prepared and rendered to the employees on or before 28 February 2021 to enable them to complete and submit their respective Return Form within the stipulated period. State or Local Law Enforcement 0389 07172012 Form 433-A.

Failure in submitting Borang E will result in the IRB taking legal action against the companys directors. Due date to furnish Form E for the Year of Remuneration 2019 is 31 March 2020. E Filing Lhdn 2019.

Access IRS Tax Forms. Go to Developer and then choose the controls that you want to add to the document or formTo remove a content control select the control and press Delete. Once you have downloaded the PDF format for Form E you will need log in to ezHasil portal to submit Form E.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Every employer shall for each year furnish to the Director General a. Click on Sign and Submit button to submit your e-Form.

Every company needs to submit Form E according to the Income Tax Act 1967 Akta 53. Select e-Borang under e-Filing. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees.

BORANG E 2019 Nama majikan. Yang ni admin anggap korang tahu. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To File Your Income Tax In Malaysia 2022 Ver

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Aplus Software Submit Borang E Cp8d Otosection

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Form E 2018 What You Need To Know Kk Ho Co

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To Download Ir8a Form Using Deskera People

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Aplus Software Submit Borang E Cp8d Otosection

Ea Form 2021 2020 And E Form Cp8d Guide And Download

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

No comments for "when to submit borang e 2019"

Post a Comment